michigan gas tax increase 2021

They note that the governor supports increased taxes. 10 In fact gas taxes accounted for about one-fifth of the 250 average price for a.

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

Gretchen Whitmer proposed a large tax hike.

. For the 2021 income tax returns the individual income tax rate for Michigan taxpayers is 425 percent and the personal exemption is 4900 for each taxpayer and dependent. The excise tax would reach 413 cpg in October 2019 563 cpg in April 2020 and 713 cpg in October 2020. The Michigan income tax has one tax bracket with a maximum marginal income tax of 425 as of 2022.

Call center services are available from 800am to 445PM Monday Friday. An analysis in June by the nonpartisan Tax Foundation found Michigans state gas taxes and fees were the 10th-highest in the nation at 4512 cents per gallon. Gretchen Whitmer proposed increasing the gas tax by 45 cents in order to repair Michigan s roads.

Effective May 1 2021 through May 31 2021 the rate for gasoline was established at 141 cents per gallon and the rate for diesel fuel was established at 157 cents per gallon. Thus far in 2021 two statesColorado and Missouri have raised their state gas tax although technically it was a fee in Colorado. The Michigan excise tax on gasoline is 1900 per gallon higher then 66 of the other 50 states.

The President plans to get most of that money by permanently raising the corporate tax rate from 21 to 28 and making it harder for multinational corporations to avoid taxes. At the time of writing this article it remains that way and Florida continues to collect taxes at the pump. Potential Increases and Reforms in 2021 Mackinac Center Policy Forum Virtual Event At the beginning of the last legislative term Gov.

This includes many below the poverty line which is currently 26200 per year for a family of four. 452221 gallons 411541 highway 40680 nonhighway State lawmakers are considering increasing the gasoline tax by 6 cents and more than doubling the road-use fee paid by drivers of electric and hybrid vehicles. Included in the Gasoline DieselKerosene and Compressed Natural Gas rates is a 01 per gallon charge for the Leaking Underground Storage Tank Trust Fund LUST.

In February 2022 a 46 increase from the February 2021 level. February 2022 tax collections were. 1 2020 and Sept.

COVID-19 Updates for Michigan Motor Fuel Tax Motor Fuel Tax Return filing deadlines have not changed. It will have a 53 increase due to a rounding provision specified in the calculations. 53 rows Throw in the 184-cent federal tax and it starts to add up.

Florida gas tax totals at 265 cents per gallon. A 45-cent tax increase per gallon of gas. Currently Michigans fuel excise tax is 263 cents per gallon cpg.

Gasoline Turb ne Fuel E-85. MiMATS users should continue to use the MiMATS eServices portal. Michigan Gas Tax 17th highest gas tax.

If by the end of September the annual inflation rate ends up similar to that of the previous six years the gas tax would rise from 263 cents to. The Michigan gas tax is included in the pump price at all gas stations in Michigan. Under the governors proposal a 45-cent increase would occur in three 15-cent increments over a one-year period.

Effective April 1 2021 through April 30 2021 the rate for gasoline was established at 129 cents per gallon and the rate for diesel fuel was established at 143 cents per gallon. Fuel Tax Legislation. So far in 2021 inflation has been unusually high.

The bill in Virginia raised the gas tax by 10 cents. The exact amount of the 2022 increase will depend on the inflation that occurs between Oct. The gas tax currently sits at 19 cents per gallon while diesel is 15 cents per gallon.

An assessment by Multistate Associates a state and local government relations firm says that there is a significant risk that Michigan raises taxes in 2021. Tax collections and less-than-expected individual income tax refunds and Michigan Business Tax MBT refunds. The current state gas tax is 263 cents per gallon.

DeSantis proposed that the gas tax should be waived but didnt happen. 2300 cents per gallon -392 less than national average Total gasoline use. As of January of this year the average price of a gallon of gasoline in Michigan was 237.

On Thursday he also. Michigans excise tax on gasoline is ranked 17 out of the 50 states. Oil Gas Severance Tax.

Florida had tried to remove the gas tax altogether way before the price increases back in November 2021. 2021 diesel tax. If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon.

These tax rates are based on. In addition to state gas taxes which can make up between 5 percent and more than 20 percent of the cost of gas the federal government levies a tax of 184 cents per gallon 247 Wall St. The tax on regular fuel increased 73 cents per gallon and the tax on diesel fuel increased 113 cents per gallon equalizing both taxes at 263 cents per gallon.

Talking Michigan Taxes. Specifically the temporary gas tax floor will prevent the gas tax rate in 2021 from falling below the 2020 rate 361 cents per gallon as it would have done automatically without legislative intervention due to the tax rate being indexed in part to energy inflation. When you add up all the taxes and fees the average state gas tax is 3006 cents per gallon as of the beginning of 2021 according to the US.

Under this law in 2021 those people will get a tax increase of about 365 each. And the states gas tax as a share of the total cost of a gallon of gas stood at 177 percent. Compressed Natural Gas CNG 0184 per gallon.

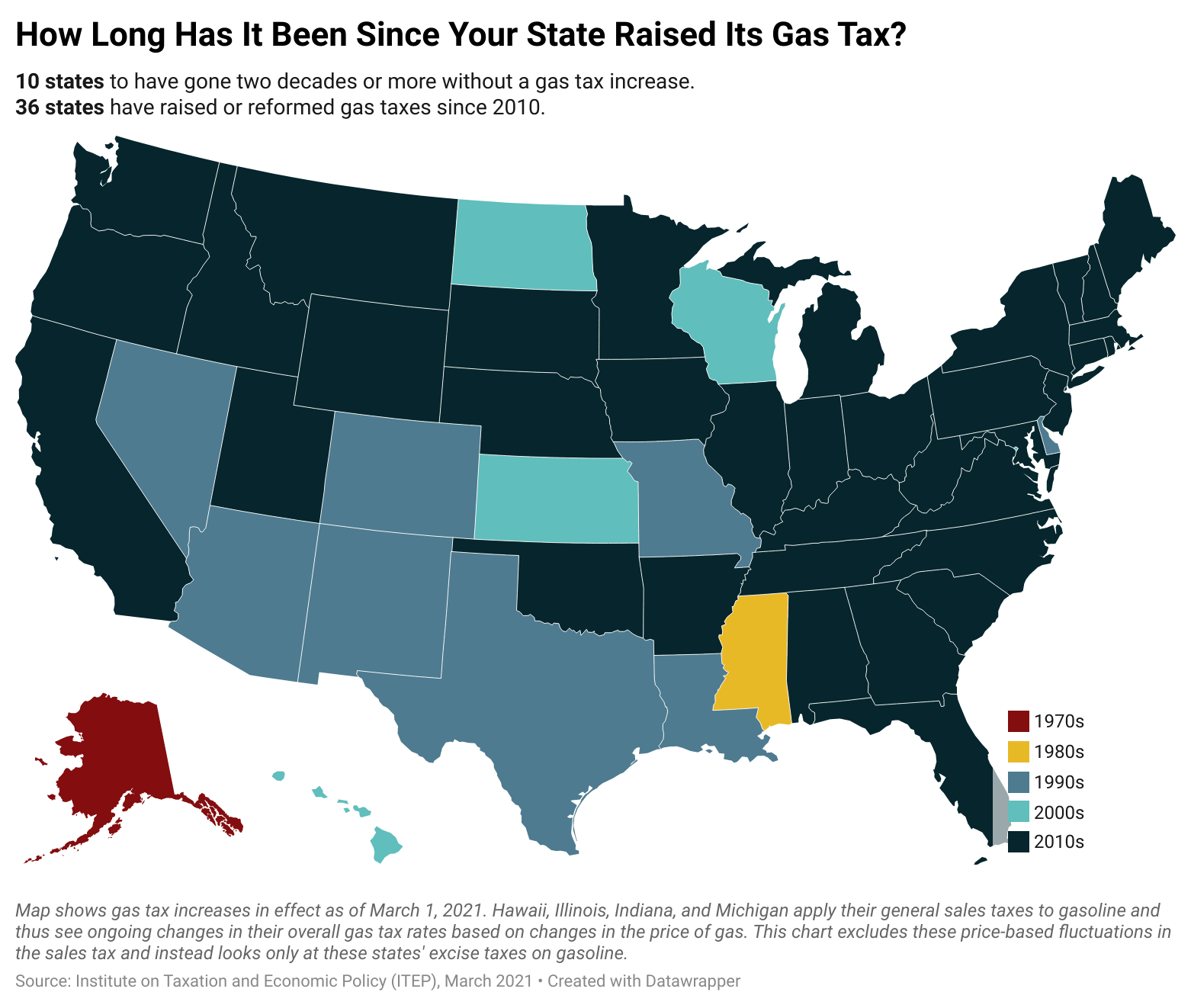

Detailed Michigan state income tax rates and brackets are available on this page. Since 2013 33 states and the District of Columbia have enacted legislation to increase gas taxes. In 2020 one stateVirginiaand DC.

The authors create an interesting framework to highlight some factors that lead to tax hikes and Michigan triggers a number of them. Combined Applicable Rate Effective July 1 2021 03610. For general questions please email TreasMotFuelmichigangov.

House Approves 6 Month Pause Of Michigan S 27 Cent Per Gallon Gas Tax

Michigan Gas Prices Hit 2021 High Here S Where It S Most Expensive In The State

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

Whitmer Mulls Gas Tax Cut Republicans Visit Trump At Mar A Lago The Week In Michigan Politics Mlive Com

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

Michigan S May Tax Proposal Mackinac Center

Michigan Gas Prices Rose 42 Cents In One Week Hitting Highest Peak In Years Mlive Com

U S States With Highest Gas Tax 2022 Statista

How Long Has It Been Since Your State Raised Its Gas Tax Itep

See How Much A 45 Cent Michigan Gas Tax Might Cost You Bridge Michigan

What Does An Additional Penny Of Gas Tax Buy Bridge Michigan

How Long Has It Been Since Your State Raised Its Gas Tax Itep

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

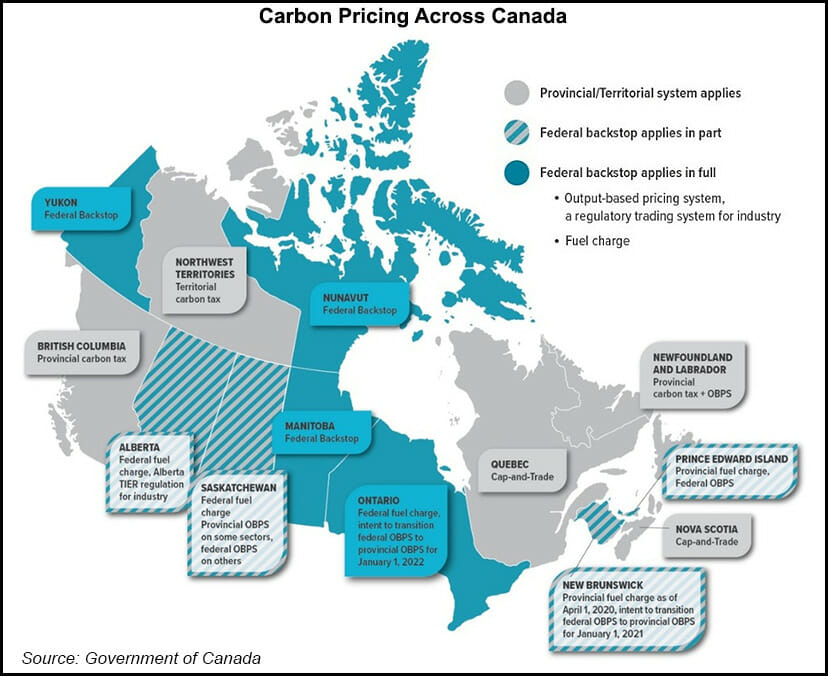

Canada S Scheduled Carbon Tax Increases Said To Pose Implementation Risk Natural Gas Intelligence

Michigan S Gas Tax How Much Is On A Gallon Of Gas

Just In Time For 2021 Inflation Spike Michigan Gas Tax Getting Cost Of Living Increase Michigan Capitol Confidential

Gop Outraged As Gov Gretchen Whitmer Rejects Gas Tax Holiday Michigan Income Tax Cut Bridge Michigan

Michigan Gas Tax Going Up January 1 2022

Michigan Republicans Announce Plan To Suspend State Gas Tax For Next 6 Months